March, 2022

What Will Home Prices Will Look Like In 2023? According To Fannie Mae

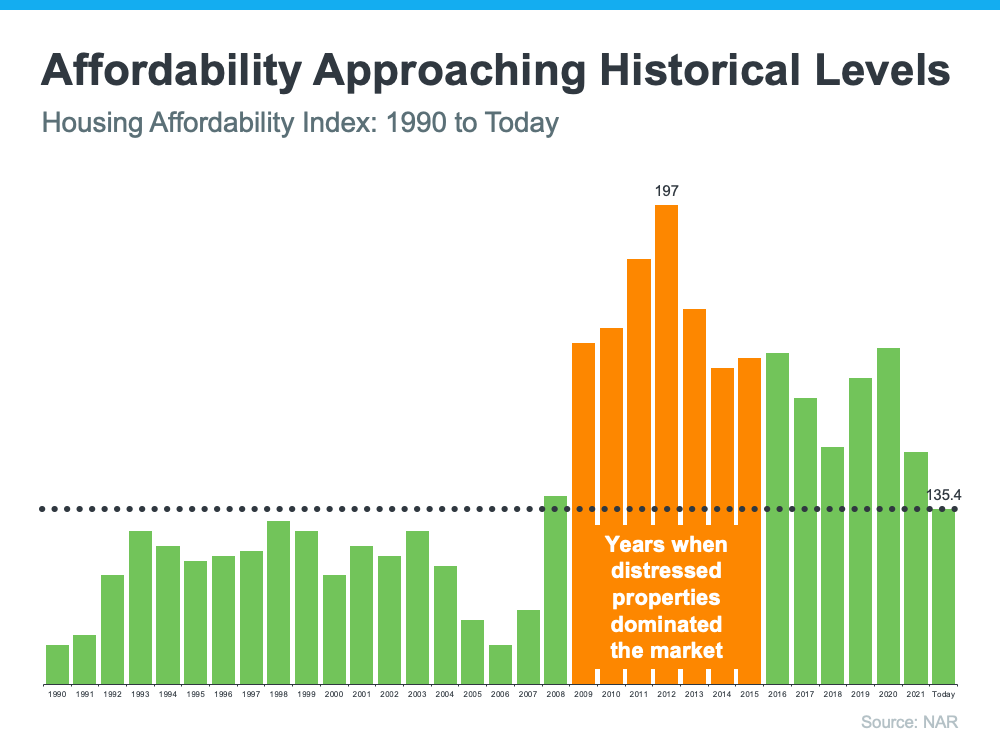

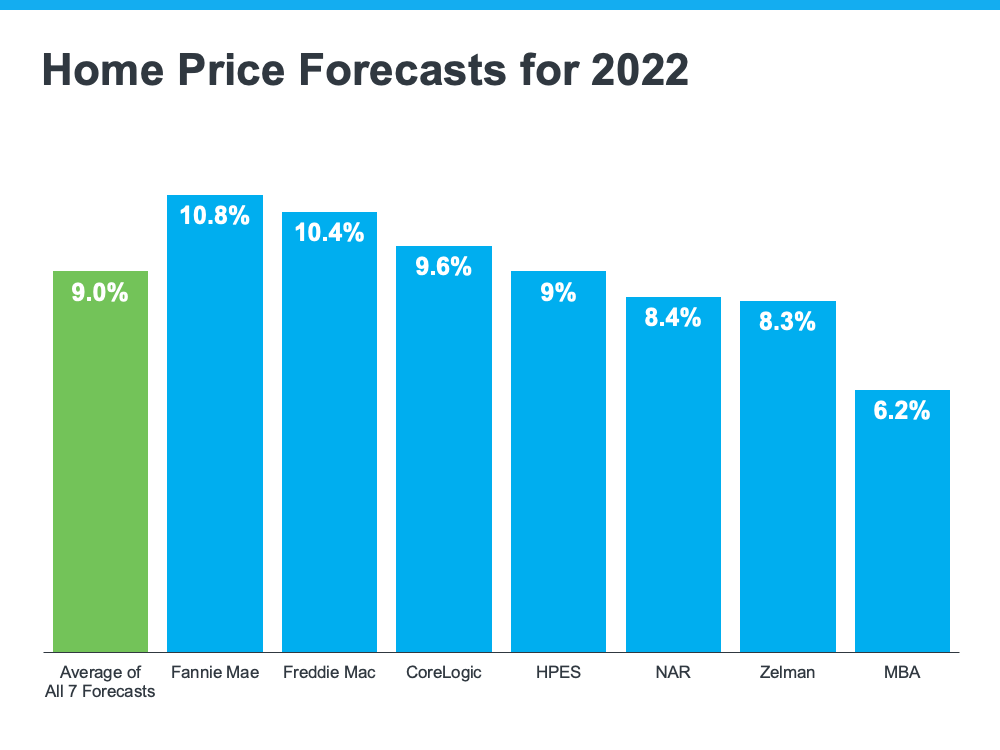

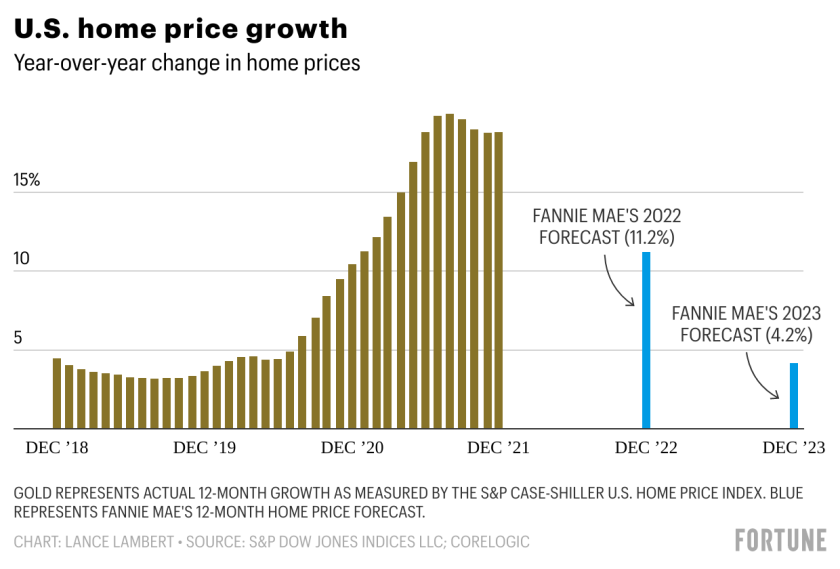

Heading into 2022, the consensus of analysts covering the real estate market was that home price growth would decelerate significantly during this year. But in two months, what a difference. Already some of the same firms that projected this deceleration are backing off their forecasts. Zillow, for example, forecasted that price growth would decelerate to 11 percent this year, from the December 2020 to December 2021 growth of 18.8 percent. Well, during February, the company revised that growth rate back up to 17.3 percent.

And Zillow isn’t alone. Fannie Mae, a leading source of mortgage financing in the U.S., just became the latest real estate firm to up their 2022 forecast. During 2021, Fannie Mae predicted that the median existing home price would climb 7.9 percent during 2022. Now, the company believes that the median existing home price in 2022 will jump from $355,000 to $384,000; an increase of 11.2 percent, year over year. (This is a national number, the price increase will vary from state to state and locale to locale).

Granted, if home prices do rise another 11.2 percent, it would indeed mark a deceleration from the 18.8 percent growth noted above. However, that would hardly represent relief for home buyers who have witnessed this unprecedented surge in prices. After all, the typical raise that corporate America plans to dole out this year is only 3.9 percent.

According to Fannie Mae, relief may be on the way. But not this year. Buyers will have to wait till 2023 when home prices are projected to rise by 4.2 percent, with the median existing home price increasing to $395,000 (See Graph, Fortune).

Why are 2022 forecasts suddenly getting revised upward? Readers of Market Watch probably know the answer, and those trying to purchase a new home are living it. The answer is the lack of available homes for sale.

For much of the past 24 months, the underlying issue in the housing market has been a lack of inventory. And it is continuing. Last month, Bridgewater had just .86 months of available homes, Branchburg 1.73 and Hillsborough 1.31. With a wave of first-time millennial home buyers, coupled with low mortgage rates, available homes are still being gobbled up quickly, keeping inventory extremely tight. Forecasters had believed that this problem would abate this year. But it hasn’t.

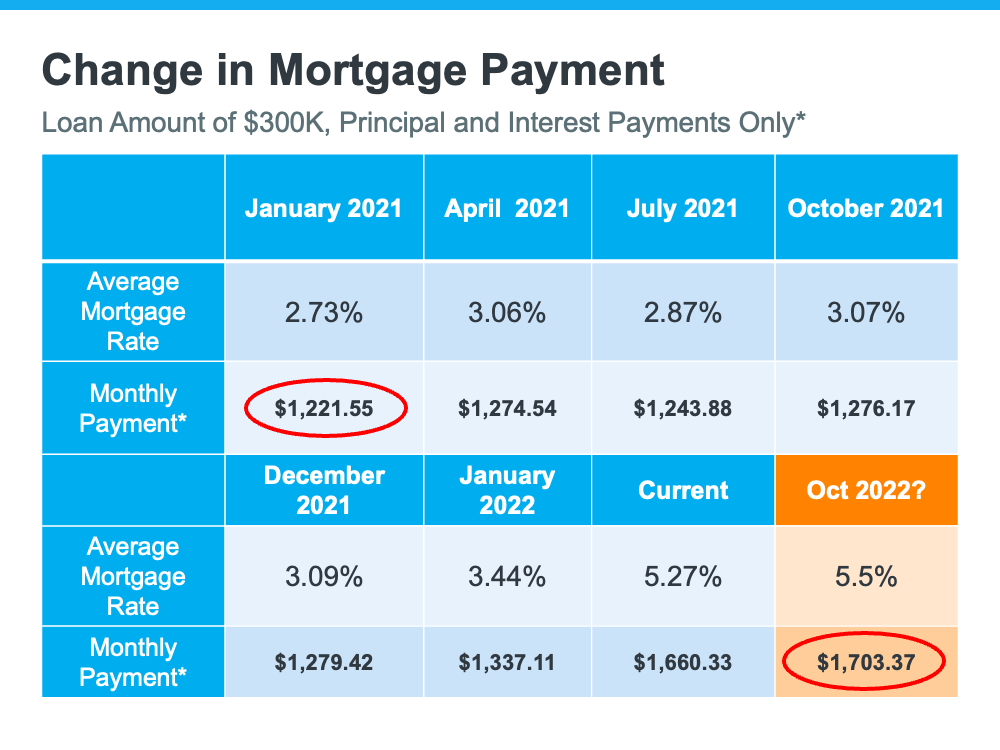

Fannie Mae believes this should change next year. Already, mortgage rates are rising and hovering around 4 percent. And the Federal Reserve is hinting at rate increases. Rising mortgage rates cause monthly payments on new mortgages to rise as well. Higher mortgage rates, coupled with the increase in home prices over the past months, should pressure more buyers to rethink their plans. When that happens, home price growth could finally begin to normalize. Again, that is what Fannie Mae believes. “The effect of buyers being priced out should mean fewer bidding wars and slower house price appreciation,” wrote Fannie Mae economists in their latest outlook.

(Information and the chart for this section is credited to Fortune)

Two Important “Concepts” When Analyzing Demand In the Housing Market

Readers of Market Watch may be acquainted with these concepts. They have been presented in several of the past issues of Market Watch when discussing supply, demand and the rise of mortgage rates in the housing market. But considering the continued tight market and the Feds apparent willingness to push rates up, it may be a good idea to reintroduce these rules.

The first is the month’s supply of available homes. Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. The lower the number means the lower number of homes available; the higher the number, the higher amount. It also would indicate whether the market favors sellers or buyers. Numbers ranging from 0 to 4 would indicate a seller’s market, since the inventory of homes is low and cannot satisfy buyer demand. Numbers above 6 would indicate a buyer’s market where the supply homes is high, surpassing demand, and favoring buyers. When the number is 5 to 6, it is basically a neutral market where neither sellers or buyers are favored.

Right now, Bridgewater’s number is .86, Branchburg’s 1.73 and Hillsborough’s 1.31. These numbers indicate that supply is not close to meeting demand and that sellers are favored in these areas, and should be for sometime.

The second concept has to do with the effect of a rise in mortgage rates on buyer affordability. The concept is that a one point rise in mortgage rates decreases affordability by approximately 10 percent. For example. If a buyer can afford, based on income and liabilities, a $500,000 home at a mortgage rate of 3 percent, and the rate climbs to 4 percent, the home buyer can only afford a $450,000 home. A significant difference that could decrease demand. Of course, this is a general rule, and affordability can be influenced by many other factors. But this is a good guide when examining how a rise in mortgage rates can change demand for housing.

Just A reminder Regarding Home Insurance

As you are probably aware, home values have soared over the past two years. As such, it is important to take a look at your homeowner’s insurance to see if you are adequately covered in case of a loss. The question to ask is, can I fix or even rebuild my house based on current material and labor costs which have also increased? And, am I in a position to cover living expenses during the time it takes to do the rebuild?

It may be a good idea to reach out to your homeowner’s insurance representative and have that discussion. Have them review your current policy and give you recommendations on any gaps, discounts, or improvements that can be made to your existing coverage.

To have a beneficial conversation with your insurance representative, you are probably going to need the current value of your home. As your local realtor, I can easily provide that number by conducting a competitive market analysis.

This simple exercise can provide you with the peace of mind knowing that you are properly covered in the event a disaster strikes.

Al Fross is a Coldwell Banker Realty Sales Associate based in the Bedminster/Bridgewater office. Al has lived in the Bradley Gardens section of Bridgewater since 1993 and has been an active volunteer in many recreational and community organizations including serving as the past Chairman of the Township’s Planning Board and past member of Bridgewater’s Board of Adjustment. His knowledge of the Bridgewater and surrounding areas makes him the perfect “partner” when selling your existing property or buying your new home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link